Table Of Content

- How can I lower my home insurance quotes?

- Home Insurance Company Reviews

- How to save on home insurance policy renewals in California

- Compare home insurance quotes for April 2024

- Get a free homeowners insurance quote online or call for advice

- Cheapest homeowners insurance companies of April 2024

- Average Cost of Home Insurance by Company ($750,000 in Dwelling Coverage)

While the state you live in plays a role in the cost of your insurance, so does your ZIP code. The interactive map below shows home insurance rates from across the state to help you compare. Finding ways to cut homeownership costs is a top priority for many people. One of the best ways to do that is by comparison shopping your homeowners insurance. We evaluated average rates for large home insurance companies in California to help you get started. ZIP codes were ranked based on the average rates for dwelling coverage of $300,000, liability coverage of $300,000, and a $1,000 deductible.

How can I lower my home insurance quotes?

Top 6 Homeowners Insurance Companies in North Carolina of 2024 - MarketWatch

Top 6 Homeowners Insurance Companies in North Carolina of 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

Speak with a licensed homeowners representative who can guide you through your quote. Developers built fewer homes in California in 2023, potentially leading to higher prices and rents as a supply shortage worsens. While this may seem like good news for homeowners, it is actually one of the many factors that contributed to the market instability plaguing the state.

Home Insurance Company Reviews

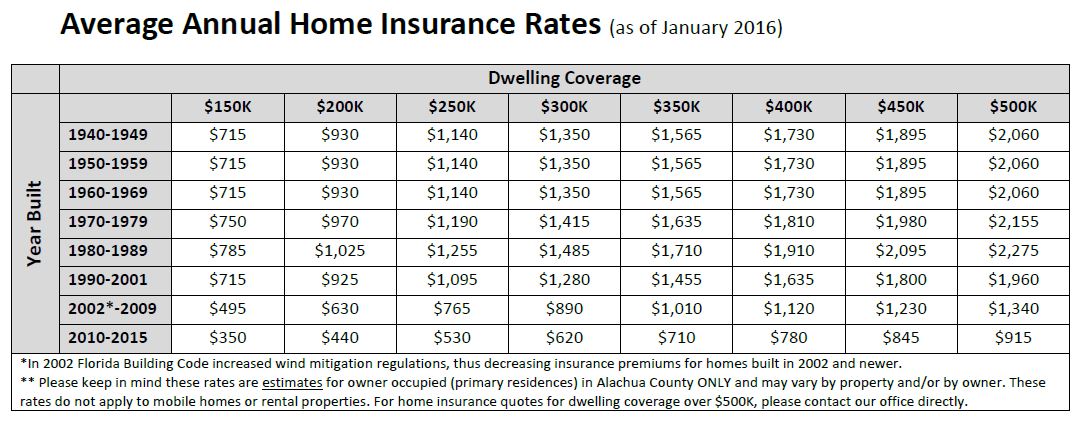

On average, it's roughly $800 cheaper to insure a new home compared to one that's 30 years old. The home insurance market has faced several challenges in recent years and with 2024 well underway, we are better able to see the ripple effects. Insurance is reactionary — it takes some time for insurance companies to recoup losses (in the form of increased premiums) caused by inflation, widescale extreme weather-related disasters and other complex challenges. A standard home insurance policy (often called an HO-3) covers your house for any problem that’s not specifically excluded in your policy (such as earthquakes and floods).

How to save on home insurance policy renewals in California

We compiled the nationwide average home insurance costs based on different coverage amounts, all with a $1,000 deductible. You can compare average rates for 10 coverage levels in the table below. Here’s how much homeowners insurance costs on average per year by state and dwelling coverage amount. Personal property coverage (Coverage C) limits are calculated by taking a percentage -- such as 50% -- of your dwelling coverage. For instance, if you’re dwelling coverage is set at a $300,000 limit, your homeowners policy will offer $150,000 for personal property coverage. We're the only homeowners insurance company that lets you compare home insurance quotes and coverages from multiple providers.

Compare home insurance quotes for April 2024

The average cost of home insurance in the U.S. is $146 per month, according to Policygenius' analysis of home insurance rates in every U.S. state and ZIP code. With the increase in insurance rates nationwide over the last year, we ran a survey in February 2023 to see what homeowners did last year to offset these high costs and lower their insurance bill. A home insurance deductible is the amount you’re required to pay out of pocket on each claim before your insurance kicks in to cover the remainder of the costs. Every home is different, which means insurance companies rate each home on a case-by-case basis.

Get a free homeowners insurance quote online or call for advice

Where you live is a big factor in how much you’ll pay for homeowners insurance. Hover over your state on the map below to see the average home insurance cost. To figure out home much homeowners insurance you need, you’ll want to get an estimate of your home's rebuild value as well as the combined value of your assets. From there, you’ll have a better idea of how much coverage you need for the rest of your policy coverages. You can calculate your dwelling coverage limit with an online dwelling coverage calculator, a professional appraisal, or by finding out the build price per square foot in your area and estimating it yourself. Regardless of how you go about calculating your dwelling coverage limit, you should make sure it's high enough to cover the home's replacement value, which is the price to rebuild it at today's prices.

To get the best rates for your situation, shop around with at least three to five insurance companies. By comparing rates from multiple insurers, you can get the best possible coverage at the lowest price. Your home insurance cost will also depend on how much coverage you need. Homeowners in California requiring $500,000 in dwelling coverage will pay an average of $1,299 annually, but those in the state only needing $200,000 in dwelling coverage pay an average of $707.

Average Cost of Home Insurance by Company ($750,000 in Dwelling Coverage)

Also considered are the materials your house is built with, such as brick, stucco, wood or stone. If you're running a business out of your home, you may not be eligible for coverage or pay a higher homeowners insurance rate. It often depends on the nature of your business, and your insurer may require you to purchase a separate policy. Mercury only writes home insurance policies in 10 states, California being one of them, and may appeal to homeowners who prefer a smaller company. Its difference in conditions, in particular, may appeal to homeowners who have had to resort to the California FAIR plan, an insurance program for homeowners unable to secure coverage in the private market. The difference in conditions endorsement can help fill in coverage gaps found in the FAIR plan, such as rain, theft, water service line and liability coverage.

4 Best Homeowners Insurance Companies in San Diego (2024) - MarketWatch

4 Best Homeowners Insurance Companies in San Diego ( .

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

You may qualify for discounts if you have a burglar alarm, automatic fire protective sprinklers, or a centrally monitored security system in your home. Mark Friedlander is director of corporate communications at III, a nonprofit organization focused on providing consumers with a better understanding of insurance. Natalie Todoroff is an insurance writer for Bankrate, prior to which she wrote for a popular insurance comparison shopping app. She has a Bachelor of Arts in English and has written over 800 articles about insurance throughout her career. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity.

She has more than 15 years of experience writing, editing and managing content in a variety of industries, including insurance, auto news and pop culture. An Office of Insurance Regulation January analysis of insurance claims found most claimant lawsuits came only after carriers delayed payment to policyholders, sometimes by more than a year. The GOP-led legislature has tightened the noose around customers in the last five years, repeatedly making it harder and harder for customers to sue their insurance carriers. They say that frivolous lawsuits against carriers have artificially inflated Florida’s insurance policy costs. Texas nears the top of the list of states with the fastest-rising home insurance rates.

Some insurers offer tools for estimating how much their home insurance will cost. These features typically use a limited set of information, but they will at least give a sense of your potential costs. You may want coverage for events that a standard home insurance policy won’t cover.

The states with the cheapest average cost of homeowners insurance in 2024 are South Dakota, Hawaii, Vermont, Oregon, and New Jersey. All of these states have average home insurance premiums of under $1,000 a year for a home with $300,000 in dwelling coverage. For example, if you have $200,000 worth of insurance for dwelling coverage, you probably have $20,000 or 10 percent of coverage A allotted for other structures coverage. Depending on your state, you may also have separate deductibles for wind or other storm damage. That additional deductible will also likely be calculated as a percentage of your dwelling coverage. If you have previous homeowners insurance claims, you’ll likely pay a higher rate.

No comments:

Post a Comment